Updated on Aug 29, 2025: If you want to open a new Wealthsimple Trade non-registered personal account, please use our referral code: (you can email us for the referral code: canadianrewards@gmail.com), thanks. You will earn $25 bonus from Wealthsimple. And you will have your own referral code after registration. If you like a TFSA / RRSP account, you can sign up it after you receive the referral bonus.

Wealthsimple Trade is Canada's first $0 commission stock trading app. Wealthsimple Trade lets you buy and sell thousands of stocks and exchange-traded funds (ETFs) on major Canadian and U.S. exchanges with $0 commissions on any trades. And you can start trading as little as $1. Note: Wealthsimple Trade is NOT Wealthsimple Invest. Wealthsimple Invest is an automated investing service that manages your investments for you using a personalized portfolio of low-fee ETFs. From my point of view, I like Wealthsimple Trade most.

Wealthsimple Trade is a division of Canadian ShareOwner Investments Inc., a registered investment dealer and a member of Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Customer accounts protected by CIPF within specified limits in the event ShareOwner becomes insolvent. For an individual holding an account or accounts with a member firm, the limits on CIPF protection are generally as follows:

4) The easiest method is "Market Buy". Enter the number of shares you want to purchase and submit your order. If you like, you can also choose the other 3 methods.

- $1 million for all general accounts combined (such as cash accounts, margin accounts and TFSAs), plus

- $1 million for all registered retirement accounts combined (such as RRSPs, RRIFs and LIFs), plus

- $1 million for all registered education savings plans (RESPs) combined where the client is the subscriber of the plan.

The Wealthsimple trading workflow is very simple (we only show the "BUY" workflow here. The "SELL" workflow is similar):

1) Click "Funding" to add fund to your account. You can link a bank account first, then deposit fund from your bank's chequing or savings account. Usually, you need to wait 2 business days before you can use the fund for trade.

2) Click the Search button to search the name or symbol of your stock. Or you can browse stocks in the "Top lists" & "Categories".

3) Click the stock symbol and then click "Buy". Note: you can choose between 4 different methods.

5) "Fractional Buy" is a new method. Some stock shares these days are expensive. A single share of Amazon is worth more than USD $3,500, and Alphabet (Google’s parent company) is worth around USD $3000 now. Not everyone who’d like to own Amazon or Alphabet shares can pony up that amount to purchase a single share. So, in Wealthsimple Trade, some stock shares can be broken down into fractional shares, allowing more investors to buy a piece of their favorite company.

Here’s how it works:

- Open the latest version of the Wealthsimple Trade app and search for “Fractional Trading.”

- When you are ready to buy, select the stock you want to purchase a fractional share of.

- Enter the dollar amount you want to invest ($200, $100, $1, etc.) and Wealthsimple Trade will tell you the estimated quantity of shares you’ll get.

- Similarly, when you sell a fractional share, you just enter the quantity of shares you want to sell (13.5, 0.7, 0.1, etc.) and Wealthsimple Trade will tell you the estimated total value.

- Orders for fractional shares are currently traded once a day. You will receive the execution price at the time the order is sent to the market.

Below is a list of fees associated with Wealthsimple Trade normal day-to-day transactions. The only trading fee Wealthsimple charge is a currency exchange fee for USD trades of the daily corporate rate * 1.5%.

I have a Wealthsimple Trade non-registered personal account myself, which is quite easy to set up and no need to worry about capital gains tax. In addition to the personal account, Wealthsimple Trade also provides TFSA and RRSP trade account types.

If you signed up to Wealthsimple Trade within the last 30 days but forgot to use your friend's referral link, you can still get the bonus:

- Sign into the Wealthsimple Trade app on your mobile device

- Tap the gift icon at the top of the screen

- Select "I was referred by someone" near the bottom of the screen

- Enter the unique code from your referral link (the series of letters found at the end of the URL)

If you don't see "I was referred by someone", it's likely your account has been open for longer than 30 days.

As far as I am concerned, I think Wealthsimple Trade is good for trading beginners. If you are an advanced trader, I would like to introduce another trading platform - Questrade: https://www.canadianrewards.net/2020/09/questrade-online-brokerage-introduction.html

Updated on Nov 29, 2020: Wealthsimple Trade just released its web beta test version. Some users got the early access to the web version of Wealthsimple Trade.

Updated on Dec 17, 2020: Wealthsimple Trade on web is now available to everyone! There are some new web features for a great experience. Now you can open new accounts (RRSP, TFSA, or Personal) and make deposits and withdrawals using the web version.

Updated on Jan 11, 2021: More Wealthsimple Trade features coming soon:

- Notifications when stock prices move

- News and updates about stocks you follow

- 2FA security

Updated on Feb 6, 2021: Internal transfers into registered accounts are now supported on Wealthsimple Trade. Just open the app and click "Funding" -> "Transfer funds". It will take one or two business days.

Updated on Apr 1, 2021: Wealthsimple recently launched instant funding for Trade and Crypto, meaning you can access up to $250 within seconds of initiating a deposit.

Updated on Apr 9, 2021: When you buy a premium subscription to Wealthsimple Trade, you’ll gain access to real-time market data through snap quotes instead of seeing a 15 minute delay. And, you will be able to deposit up to $1000 (instead of $250) with no holds (coming soon). The upgrade price is $3/month + tax. How to buy a Wealthsimple Trade premium subscription:

- Sign into the app on your mobile device

- Tap the Profile icon in the top left-hand corner

- Tap “Settings”

- Tap “Premium” under the Subscription heading

- Select “Upgrade”

- Choose the account you want your monthly subscription payment to come from

- Select “Confirm”

You can cancel your subscription anytime. Your premium subscription will remain active until the end of your billing cycle.

Updated on Aug 10, 2021: You can set up auto-deposits for Personal, RRSP, TFSA, and Crypto accounts in your Wealthsimple Trade app. Auto-deposits are recurring weekly, bi-weekly, or monthly transfers from your bank account to your Trade account. They’re a great way to automatically set aside money to build your wealth — plus, it means you’ll have funds ready to go when you want to trade. When you add funds, you’ll see the option to switch from one time to weekly, bi-weekly, or monthly. Auto-deposits take 3-5 days to become available from the time they’re initiated. Let’s say you have an auto-deposit set up on the 15th of every month — those funds will be available 3-5 business days from the 15th.

Updated on Dec 2, 2021: In Wealthsimple Trade, some stock shares can be broken down into fractional shares, allowing more investors to buy a piece of their favorite company. The central reason an investor may want to buy a fractional share is to gain the ability to invest in a company whose full shares are trading at a price that’s out of reach. Someone who can’t afford a single share of a given stock can still become a shareholder by purchasing a portion of a share. Even if you’re able to afford a full share of the stock you want, buying fractional shares could be a smart decision. Buying portions of shares of multiple companies instead of a full share of a single company lets you diversify your portfolio, thereby reducing your risk. Please see details in this post on how to buy / sell Fractional Shares.

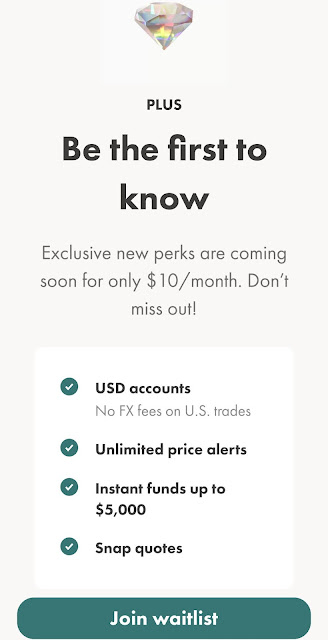

Updated on Dec 10, 2021: Wealthsimple Trade new Plus subscription is everything in your current Trade account, plus...

- USD accounts: no more 1.5% FX fee per trade. With Plus, you can buy, sell, and hold stocks and ETFs in US dollars. You will pay a 1.5% fee whenever you convert the money in your account between CAD and USD.

- Unlimited price alerts: get notified when your favourite stocks move

- $5,000 instant deposits:Increased instant deposits help you make trades when you want to.

- Snap quotes: Plus clients get real-time, up-to-the-minute market data (no more 15 minute delay on stock prices.)

Pricing for the Plus subscription is simple: $10 CAD/month. You can join the waitlist for early access of Plus subscription. You can expect an invite in January, 2022.

Updated on Feb 24, 2022: Some Wealthsimple Trade users have got early access to the new "Spend" tab in the Wealthsimple Trade app. You can now access your Wealthsimple Cash card directly from the Wealthsimple Trade app and move money seamlessly between your Trade, Crypto, and Cash accounts. Making it easier than ever to keep track of your balances (just be sure you have the latest version of the Wealthsimple Trade app). For now, getting paid, sending money, and splitting the bill is still powered by the Wealthsimple Cash app. It is nice that Wealthsimple is actively working on more ways to help user manage day-to-day finances and investments all in one place. Hope to see more improvements in the future!

Updated on May 12, 2022: Markets can move fast. So, Wealthsimple Trade now provides unlimited price alerts for free. With price alerts, you can set custom notifications for any stock, crypto, or ETF you’d like to watch. Translation: you can now ditch the separate apps to keep tabs on the market.

Updated on Mar 23, 2023: Options trading has come to Wealthsimple. It’s a great way to diversify your portfolio that’s more affordable than buying and selling outright. An option is a contract that gives you the right (but not the obligation) to buy or sell a stock at a specific price by a certain date. Options come with the potential of greater returns relative to your initial investment, but also greater risk. Instead of charging separate contract fees, commissions, and wait-what-even-is-this fees, Wealthsimple keeps its options pricing flat, starting at just $2 USD per contract.

Updated on Dec 21, 2023: Extended-hours trading allows investors to buy and sell securities outside the standard trading hours of major exchanges. While the traditional stock market operates from 9:30 AM to 4 PM ET, extended-hours trading allows investors to trade before the market opens (pre-market) and after it closes (post-market), providing investors with the opportunity to react to global events and news. Now you can trade during extended hours in Wealthsimple Trade app. Currently, only a limited selections of US listed stocks and ETFs are available for trading during extended hours. You can browse eligible securities by searching for or selecting the "Extended hours trading" category from the "All categories" tab on the Discover page. To trade during Extended Hours, place a "Good during Extended Hours" limit order on an eligible security during outside market hours. Eligible securities are indicated by the phrase "Extended hours available" next to the limit order option in the order type selection screen during extended trading hours.

Updated on Feb 7, 2025: The original Wealthsimple Trade Foreign Exchange Fee is 1.5% when exchanging CAD and USD. But now Wealthsimple reduced this fee as low as 0%. The more you convert in a single transaction, the lower your fee.

Updated on Mar 15, 2025: Wealthsimple is in the process of introducing a new account type, Wealthsimple Portfolios, which will allow clients to choose and customize portfolios. The automated trading and rebalancing fee for a Wealthsimple Portfolio account varies by your client tier, as set out below:

- Core: 0.5%

- Premium: 0.4%

- Generation: Starting at 0.4%, as low as 0.2%

While your tier determines the fee rate, you are charged the Wealthsimple Portfolio fee on your assets in each Wealthsimple Portfolio account. For your Wealthsimple Portfolio account(s), Wealthsimple calculates the fee on a daily basis by dividing the annual fee by 365 days and applying it to the closing market value of your Wealthsimple Portfolio account on that day. These daily portions are added together and charged to your account monthly. In short, our fee is quoted annually, calculated daily, and applied monthly. The end result for you, as a WSII client, is that your account will see a small charge each month.

Updated on May 30, 2025: Now, you can trade US stocks and ETFs 24 hours, 5 days a week at Wealthsimple Trade.

BTW, if anyone wants to leave his/her referral link below, please use the following format ONLY: "My Wealthsimple Trade referral link is, thanks: *******." Other format will be deleted. Thanks. Note: because it contains link, we need to approve referral comments one by one. So, please be patient...