Updated on Sep 25, 2025: As of October 1, 2025, there will be a few changes on Wealthsimple Chequing Account and Wealthsimple prepaid Mastercard

- Wealthsimple will be retiring the 1% cash back reward of Wealthsimple prepaid Mastercard. You can continue to earn cash back up until October 1, 2025 and a final payout will be made on November 1, 2025.

- You can now transfer funds in 10+ currencies (including USD, EUR, INR, GBP and even more on the way) right from the app — with low, transparent fees using mid-market exchange rates.

- You now have access to more shipping options of bank drafts and can also send them directly to a specific recipient or third party, rather than just to your home address.

- Eligible clients can send up to $25K per day with Interac e-Transfer®, and you can now manage your sending limits in-app

- Starting October 1, Wealthsimple will reimburse all ATM fees when you use your Wealthsimple prepaid Mastercard, almost anywhere in the world. No more $5 cap, and no limits at all.

Updated on Sep 20, 2025: On September 17, 2025, the Bank of Canada and the Federal Reserve both lowered their benchmark interest rates by 0.25%. Therefore, starting on Monday, September 22, the interest rates across several of Wealthsimple accounts are changing.

Wealthsimple Chequing Account is one of the Wealthsimple products. You can use it to split takeout or rent, send a friend cash for a coffee, or request money instantly. With Wealthsimple Chequing Account there are no monthly account fee and no low balance fees. If you want to sign up and fund a new Wealthsimple Chequing account, please use our referral code: (you can email us for the referral code: canadianrewards@gmail.com), thanks. You will earn $25 bonus from Wealthsimple. And you will have your own referral code after registration.

Wealthsimple Cash product is offered by Wealthsimple Payments Inc., a FINTRAC and Autorité des marchés financiers registered money services business. Money in the Cash account is held in trust at a CDIC member institution. So, all balance in your Weathsimple Cash account are eligible for protection from the CDIC.

Wealthsimple Cash allows user to send and request money (you can add personalized messages too). There will be more new features coming. If you are interested, you can see this page: https://help.wealthsimple.com/hc/en-ca/articles/360056545414.

I like the upcoming Wealthsimple Cash Card feature. It is a Visa prepaid card. you can make every day purchases with the Wealthsimple Cash card — just add it to Apple and Google Pay.

Updated on Nov 2, 2021: Wealthsimple Cash has launched a new stock- and crypto-back feature that allows you to direct your rewards to your Wealthsimple Trade or Crypto account. Plus, auto-buy is on the way, so soon you'll never miss a chance to invest your cashback rewards. Here’s how to opt-in to stock or crypto rewards with your Cash card:

- Tap the card icon in the app

- Select Invest your rewards

- Choose stock or crypto

- Start spending

Updated on Nov 29, 2021: Starting today you'll get 1% back all day, every day, on everything with Wealthsimple Cash Card. But don't worry, you'll still have the chance to get a little extra back with bonus offers. Starting with the 5% weekend boost on eats and drinks you know and love, available to all early Wealthsimple Cash Card users until February 28, 2022.

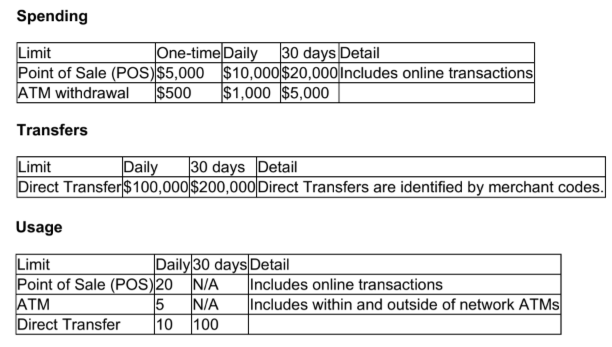

Updated on Dec 2, 2021: Please see the above tables for the transaction limit of Wealthsimple Cash Prepaid Visa Card.

Updated on Jun 8, 2022: You can send an e-transfer directly from your Cash account to anyone that does not use Wealthsimple Cash. Contacts you are able to e-transfer will appear as email addresses on your contact screen. Your recipient will see the e-transfer come through to their email. They will have the option to either download the Cash app, or deposit the e-transfer directly to their bank.

Updated on Nov 10, 2022: Wealthsimple will no longer issue VISA card to clients. Instead, all Wealthsimple Cash Cards will be affiliated with Mastercard. With this new Wealthsimple Cash Mastercard, you can get 1% back with your purchase and you can earn 1.5% interest when you save.

Updated on Apr 17, 2024: Weathsimple has increase the CDIC coverage on eligible deposits within your Wealthsimple Cash account from $300,000 to $500,000.

Updated on Aug 13, 2024: For Wealthsimple Cash Card, Wealthsimple does not charge additional ATM fees for a ATM withdrawal and Wealthsimple will reimburse Cash clients an unlimited number of ATM fee (up to $5 each). Reimbursement will be made to the account linked to your Cash card within 4 business days after the ATM transaction settles. This is a very good news for the Wealthsimple Cash clients.

Updated on Oct 22, 2024: Weathsimple has increase the CDIC coverage on eligible deposits within your Wealthsimple Cash account from $500,000 to $1,000,000.

Updated on Aug 4, 2025: You can now send wires or order bank drafts directly from your Wealthsimple Chequing Account through the Wealthsimple app.

BTW, if anyone wants to leave his/her referral code below, please use the following format

ONLY: "My Wealthsimple referral code is, thanks: *******." Other format will be deleted. Thanks.

.jpeg)