Established in December 2000, Interactive Brokers Canada is a member of the Interactive Brokers Group, a leading global electronic brokerage group. Like its U.S. affiliate, Interactive Brokers LLC, IB Canada provides its customers with direct, high-speed access to trade markets around the world.

IB Canada offers personal, margin account and registered account (including RRSP, Spousal RRSP, and TFSA accounts). IB Canada is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). For an individual holding an account or accounts with a member firm, the limits on CIPF protection are generally as follows:

- $1 million for all general accounts combined (such as cash accounts, margin accounts and TFSAs), plus

- $1 million for all registered retirement accounts combined (such as RRSPs, RRIFs and LIFs), plus

- $1 million for all registered education savings plans (RESPs) combined where the client is the subscriber of the plan.

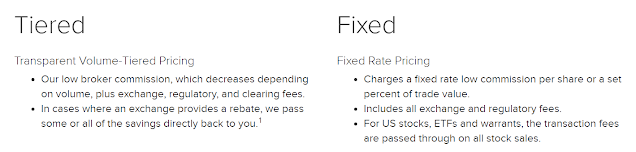

IB Canada Fixed rate commissions for US stocks are 0.005 USD/share and 0.01 CAD/share for CAD stocks. Minimum commission is $1.

IB Canada Tiered pricing for stocks, ETFs (Exchange Traded Products, or ETPs) and warrants includes their low broker commission, which decreases depending on volume, plus exchange, regulatory, and clearing fees.

So, if you are a pro day trader with large volumes of trading, you can consider the IB Canada's Tiered rate.

If you want to transfer fund to IB Canada, please follow the steps below:

- Log in to Client Portal.

- From the Transfer & Pay menu select Transfer Funds and then Make a Deposit. Select one of the saved deposit instructions and follow the prompts on the screen. Alternatively, create a new deposit instruction by selecting the Currency of the deposit from the drop-down menu.

- Select the How to button for the method you will use to transfer funds.

- Follow the remaining instructions provided to initiate the transfer with your bank.

- On a trading page, enter a symbol and choose Forex.

- In the contract selection window, choose the exchange, and choose the other currency.

- Click OK to get a quote. Say 'No' when prompted to add the pair to FXTrader.

- Click on the bid price or ask price to create an order. Choose the quantity and order details. Click T to transmit.